Accounting & Taxation

GoldNumbers is an Australian Registered Tax Agent and offer a full range of Accounting and Taxation Services. GoldNumbers Accountants proactively assist in all financial matters to ensure clients maximise their wealth, whilst at the same time minimise their Tax. This proactive approach ensures we deliver consistent service, and build strong relationships that stand the test of time!

Our Services include;

- Income Tax Returns

- Financial Statement Preparation

- Self Managed Super Funds

- Capital Gains Tax

- Fringe Benefits Tax

- Good and Services Tax (GST)

- Trust Fund Accounting

- Property Accounting

- Estate Planning

Income Tax Explained

Income Tax is paid by Individuals, Businesses and any other entity which exists to make a profit. In order to calculate Income tax we must first determine the Net Income of the Tax payer. The formula for this is generally as follows

Assessable Income – Allowable Deductions = Net Income.

Individuals derive Assessable Income from multiple sources including Salary and Wages, Dividends (from shares), Interest, Trust Distributions, Capital Gains and Rental Income.

Allowable Deductions generally include all costs related to earning your Assessable Income. Common Deductions claimed are Motor Vehicle and Travel , Computer and Hardware, Tools of Trade and Rental Expenses. Costs of a private nature are not deductible.

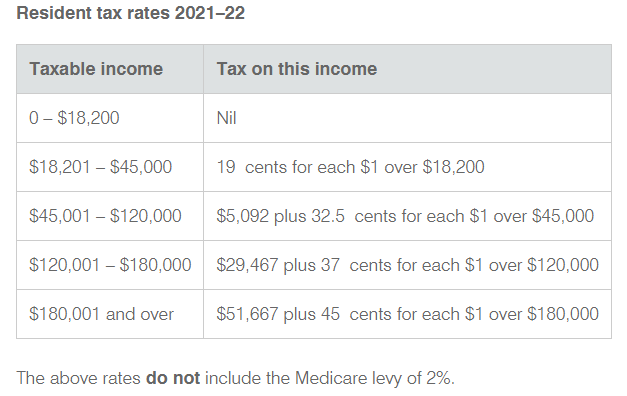

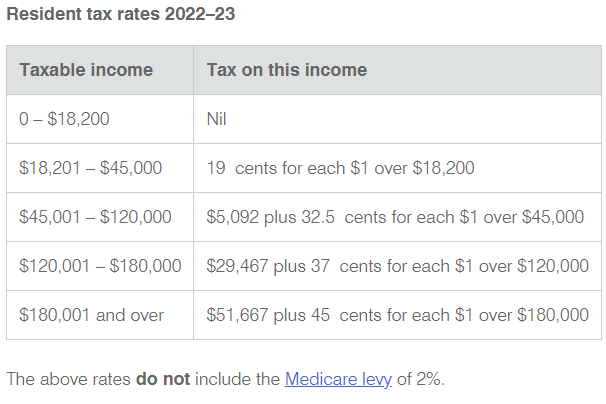

Once determined, Net Income for an individual is multiplied at the applicable rates to arrive at the Income Tax Payable. Below is a table of the Marginal Tax rates for Individuals for the 2022 and 2023 Financial Years.

Capital Gains Tax

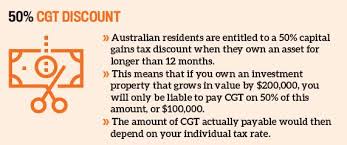

Capital Gains Tax (CGT) is a tax on the profit from the sale of Assets. This is usually in the form of Real Estate or Shares. A Capital Gain is basically the selling price of the asset less the cost price. Capital Gains are included as part of Assessable Income, and taxed at marginal rates for individuals, and the company tax rate for Corporate Entities.

Tax Payers which hold an asset for longer than 12 months may claim a CGT Discount. This is a reduction of 50% prior to assessment at the Marginal Rates. Companies are unable to claim this Discount.

Certain exemptions apply for Capital Gains Assets including the Main Residence Exemption, and other working Asset Reductions under the Small Business Provisions.

Tax Effective Structuring

Generally there are four structures available to Tax Payers. These are Individual (Sole Trader), Partnership, Company and Trust. We will touch on these below;

- Individual (Sole Trader)- Individuals are generally tax paying entities and are assessed on their Net Income at the prevailing rates outlined above. This includes distributions from Partnerships, Companies (Dividends) and Trusts. Individuals are generally tax effective when Net Income is lower.

- Partnerships- Partnerships do not pay tax, but distribute the Income of the partnership to the Partners for Tax Purposes. This Income then assessed at Individual Marginal Tax Rates of the Partners.

- Companies - Companies are separate legal entities and pay tax at a pre-determined singular rate. For small Companies this is currently 26% for 2021 FY and will move to 25% in 2022 FY.

- Trusts - A Trust does not pay tax but distributes its profits to Beneficiaries. There are generally two types of Trusts, a Discretionary Trust and a Unit Trust. A Discretionary Trust allows distributions to Beneficiaries to take advantage of an Individuals marginal tax rates. A Fixed Trust distributes to beneficiaries based on pre-determined percentages.

Superannuation and the Tax System

Superannuation are funds or benefits preserved for your retirement, and generally cannot be accessed to retirement or after the age of 65 (preservation age). Whilst under this age, the fund is known to be in an accumulation phase and openly accepts contributions from members.

There are generally two types of Superannuation Contributions. They are compulsory and voluntary;

- Compulsory Super is referred to as the Superannuation Guarantee Charge (SGC) and is required to be paid by an employer at 10.5% of an eligible employees wages.

- Voluntary Super is Super that is paid voluntary by the tax payer. This is usually on top of the SGC paid by their employer. Tax payers choose to do this to take advantage of tax savings awarded to Super Funds (15% flat Tax Rate).

Superannuation can be managed either through a large institutional fund, or through the use of a Self managed Super Fund (SMSF). An Institutional Fund accepts contributions from members and invest these according to the type of Fund they represent, and their particular Investment Strategy. Fees generally range between 1-2 per cent p.a of the total amount invested.

A Self Managed Super Fund (SMSF) allows the Tax Payer/s to manage their Superannuation for themselves. Depending on the composition of the fund, this can be an attractive option for tax payers and retirees. An SMSF may invest in Share, Real Estate or even a Private Business (Some related Party Transactions are however not allowed).

After Preservation age the Fund moves into a pension phase and cannot accept contributions unless strict criteria are met. There is no tax payable on the pension funds that are paid out to the member during this phase. Fund Members can take payments in either a lump sum or as a pension stream.

Home Strategy & Planning Business Support Services Wealth Creation About Us Contact

Copyright GOLDNUMBERS